Why Excel Based Financial Planning Software Is Your Best Choice

Building an Excel Based Financial Planning system is something that most companies will have done during their growth. Typically, such systems start off as nothing more than a means to ‘keeping an eye on the books’, but as any company grows, financial planning quickly becomes a core requirement for both purely financial and also operational needs.

What happens next is a steady and relentless development of various spreadsheets throughout an organisation, which grow into an internal system used by all departments for planning expenditure and forecasting income to predict growth and plan for a financially secure business.

These ‘home-grown’ systems eventually demand so much maintenance time that the management of them itself becomes a very significant cost to the company. At this stage, a project is eventually set up to identify a suitable commercially available database application system to handle all the budgeting planning and forecasting requirements of the company.

At this point, danger signals should be flashing red lights at the project team. These systems are expensive to implement, but are sold as great time-savers. However – get the choice of software wrong, and you’ll be back to square one and using spreadsheets again in a hurry. In fact, independent research indicates that this happens in over 81% of cases.

In this article

1. The Practical Viewpoint

2. What the surveys of Financial Planning and Analysis software are showing us

3. Which is Best – Excel or Application Software?

4. A Complete Planning Platform

5. Conclusion

The Practical Viewpoint

I was one of the co-founders of InfoCat over 25 years ago and we have specialised in implementing planning budgeting and planning applications for financial planning and analysis (FP&A), ever since we started.

Over the years, we’ve worked with many of the well-known enterprise software tools available. They all have some very strong points but, increasingly over the last few years we have seen these reach their limitations. Many are now over-technical and need very specialised resources, having moved away from their finance end-user roots.

And over the last 2 years, as we have battled through the Covid crisis, we have seen how important the issues of system flexibility, agility, end-user control, and the speed-to-value ratio have become for an FP&A team. These are all capabilities that the traditional enterprise-class products now struggle to deliver. Back to top of page

What the surveys of Financial Planning and Analysis software are showing us

Even if companies have enterprise-level software already, they very often revert to Excel, as we have seen above. They often end-up doing the actual business modelling in their large spreadsheets and then feed the results back into the corporate FP&A solutions purely for collection and consolidation! This leads to a lot of extra work, inefficiencies, and errors.

In the course of our business, we often come across large companies with 10-15 Megabyte linked spreadsheets, who are worried that they are in every way unusual and unique in their requirements for their project. They are not. The actual issue that they have is in the selection of enterprise software which can quickly connect to their existing spreadsheets and provide an easy way to maintain that system as a database.

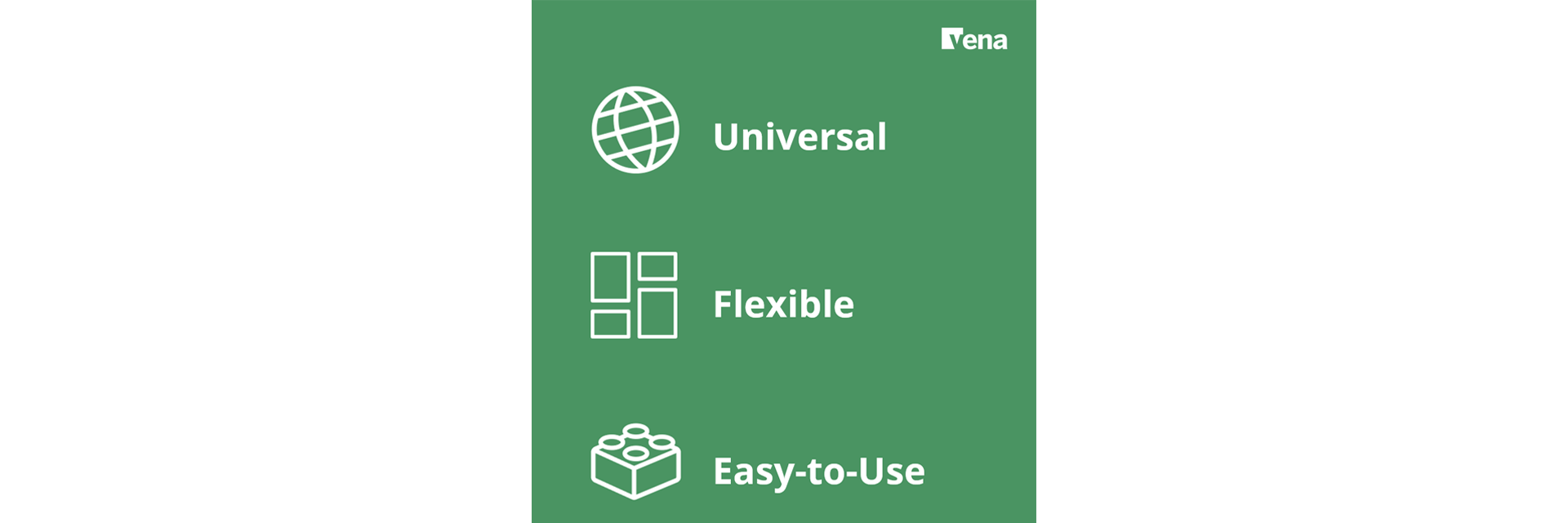

We were keen to provide our customers with these capabilities, so we started looking around for a suitable modern software vendor that we could partner with and found what we believe to be the best product in Vena Solutions. Vena took a very different approach to building an application from traditional vendors and build their solution to provide three core capabilities:

- Universal access to a very wide range of business systems (including Excel)

- Having a flexible architecture to enable straightforward system modifications

- Ease of use via a familiar interface (Excel)

In short, Vena provides a means to enable business users to connect to any system via an interface that they are fully familiar with and analyse the data that drives their business their way. This engenders high user-adoption and vastly increases the prospect of getting value for money from a software application investment. Back to top of page

Which is Best – Excel or Application Software?

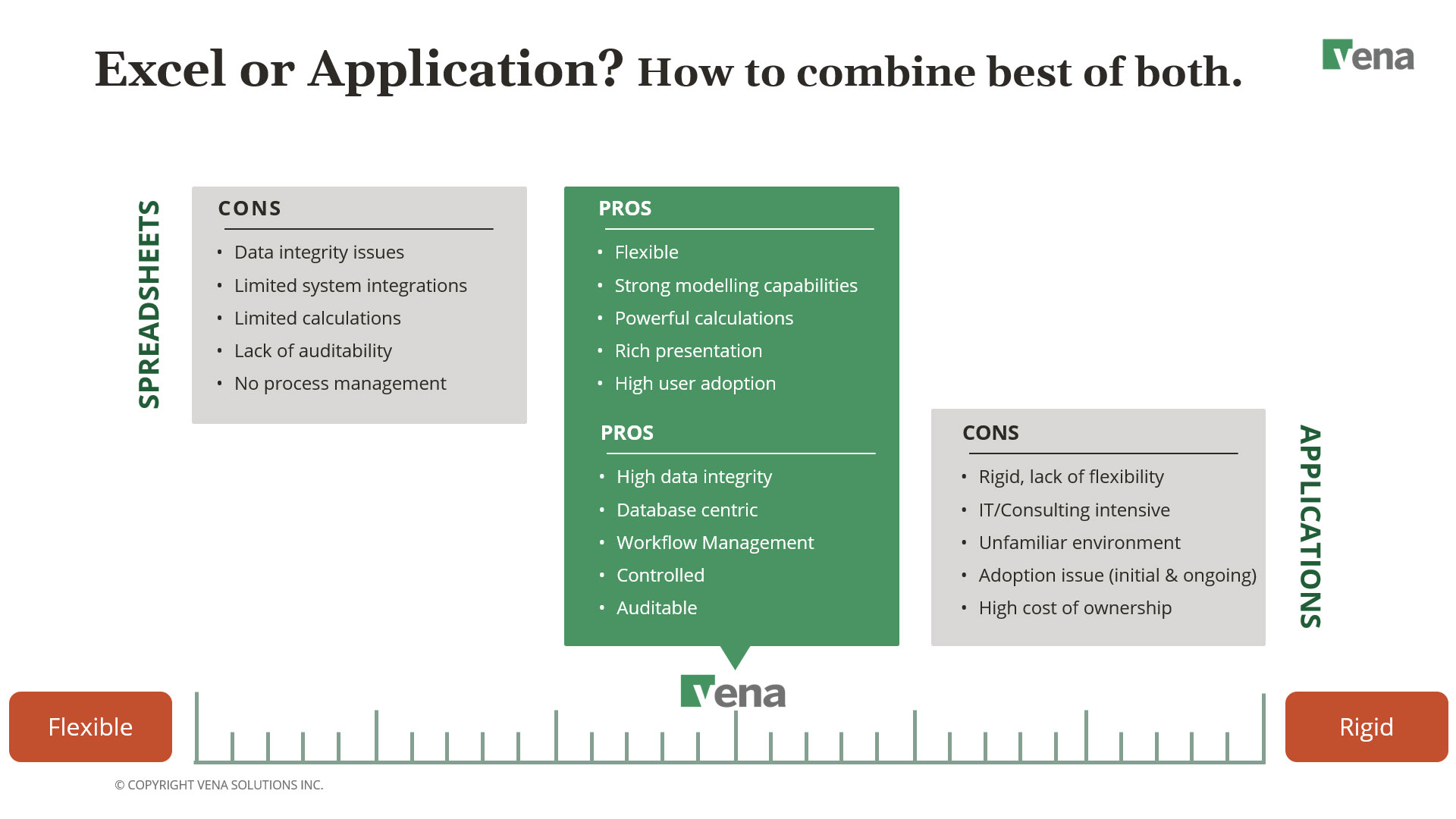

When we started looking for a solution to address the flexibility, agility, and control needed by our clients for today’s fast-moving business environment, we considered the strengths and weaknesses of both purely Excel-based systems and ‘traditional’ application systems. We were looking for a solution which provided a much faster, agile application, which required minimal specialist technical skills, and was able to use the knowledge and training of the average finance department. We found the answer in Vena Solutions and the results are summarised in the graphic below:

Spreadsheet system weaknesses are well-known. Even with the aid of a data warehouse application, they are extremely vulnerable to data-integrity issues and offer limited calculations and system integration. They also lack auditability and have no process management.

Traditional application software solves many of the spreadsheet issues, but are large and cumbersome, lack flexibility in design, and become reliant on either IT, or outsourced consulting, or both. User adoption is poor, due to an unfamiliar environment, and they quickly come to represent a high cost of ownership.

The ‘sweet-spot’ occupied by Vena in the graphic above, provides a well-designed and practical alternative, which is an ideal solution for most companies. As a result, customers can now develop applications faster, change and extend them when required, but still be sure of the accuracy and integrity of the results and analyses provided by a database centric application with direct access to critical business systems.

In the current business environment, with huge amounts of uncertainty and change around us, that is exactly the type of application we all need. This approach gives you, for the first time, the best of both worlds – all the control that you need, with an Interface which is ultimately familiar to all users, and which they are very comfortable using. Back to top of page

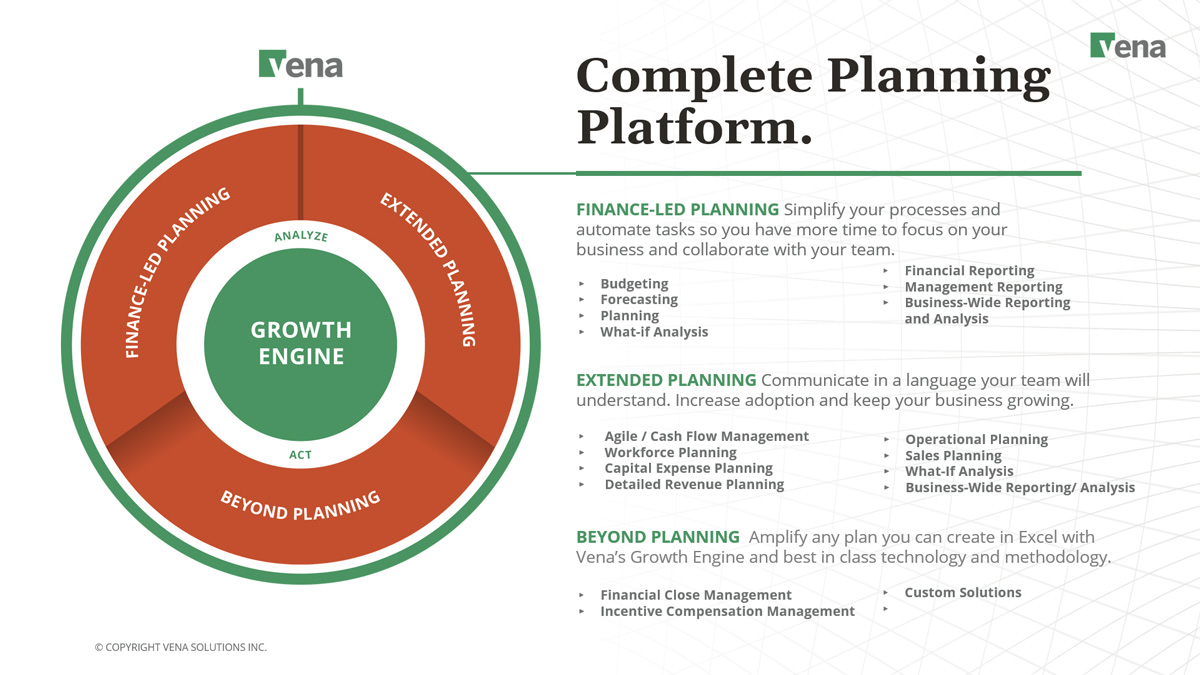

A Complete Planning Platform

We have been talking about financial budgeting and planning, which is the pain-point for many organisations. But the great thing about Vena is that it provides a platform across a wide range of Financial Planning and Analysis requirements, plus many other applications, such as sales planning, capital expenses, workforce and resource, and financial close to name a few.

Vena enables you to start with finance, then expand and integrate other business areas by providing pre-defined templates which provide for example, staff planning, and financial close, to get you up and running quickly.

Vena’s FP&A configuration automates your tedious tasks so that you can simplify your finance processes and have more time for business analysis and planning. Back to top of page

Conclusion

So, what does all this mean to our customers? In summary, what Vena provides is ultimate control for finance departments together with the ability to attain the reliability they need to reduce risk. It also delivers an advanced application platform to improve your planning, forecasting and analysis in a cost-effective solution utilising existing skills that can be implemented quickly.

With many companies now looking to more readily predict and plan on retention, lead generation, and new sales forecasting, Vena’s enterprise capabilities and platform features easily extend to companies looking beyond core FP&A and finance-led planning solutions. Back to top of page

For more information about the Vena Solutions software, please contact InfoCat for a full demonstration of the product.